Insurance is no longer a luxury—it’s a necessity. But when faced with the choice between health insurance and life insurance, which one takes priority?

Both serve crucial but different purposes and understanding them can help individuals and businesses make informed decisions. Let’s break it down.

Health Vs Life Insurance - The Core Difference

To make the right choice, first, understand the fundamental difference:

.........................Health Insurance ......................... Vs ............................ Life insurance.......................

Health Insurance

Covers medical expenses, ensuring financial support for hospitalization, treatments, and preventive care. It protects you while you're alive and facing health challenges.

Life Insurance

Provides a financial safety net for your family or beneficiaries in case of your untimely passing. It ensures your loved ones are taken care of even when you’re not around.Think of It This Way

Health insurance- is like a shield that protects you from unexpected medical bills.

Life insurance- is like safety net that ensures your family’s financial stability if you're not there.

Which One Should You Prioritize?

1️ If you have dependents (family, children, or loans to repay)

🔹 Go for Life insurance to provide financial security if something happens to you.2️ If you want to protect yourself from unexpected medical expenses

🔹 Go for Health insurance to take care of rising healthcare costs, a single hospitalization can drain savings.3️ For young professionals or entrepreneurs

🔹 Good to Start with health insurance, then gradually build your life insurance portfolio as responsibilities grow.4️ For families

balanced approach works best. Consider a comprehensive health plan along with a term life policy to safeguard both present and future financial stability.Let Me Explain You With Small Example

Imagine you are a 30-year-old entrepreneur. If you fall sick and require hospitalization, health insurance will cover your medical bills, ensuring your savings remain intact. On the other hand, if you have a family depending on you, life insurance ensures they remain financially secure in your absence.

Most Ideal & Preferred Approach

It’s not about choosing one over the other—it’s about balancing both based on your life stage, financial goals, and responsibilities. It is great idea to balance the investment in both

✅ Your medical bills don’t drain your savings (Health Insurance)

✅ Your family’s future remains secure (Life Insurance)

Most Ideal & Preferred Approach

It’s not about choosing one over the other—it’s about balancing both based on your life stage, financial goals, and responsibilities. It is great idea to balance the investment in both

✅ Your medical bills don’t drain your savings (Health Insurance)

✅ Your family’s future remains secure (Life Insurance)

Why Mahavir Consultancy?

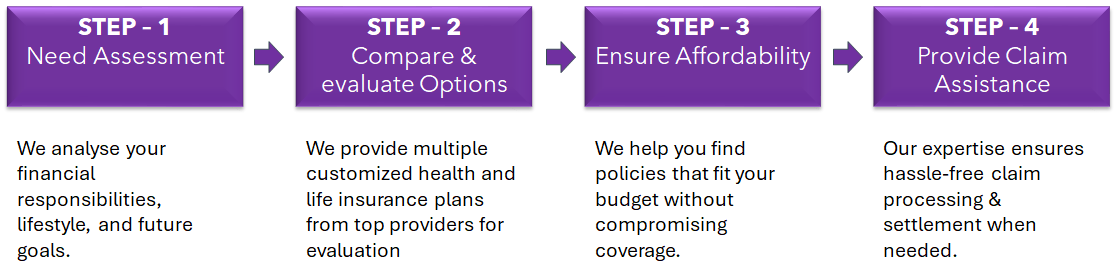

At Mahavir Consultancy helps you to choose the most suitable plan to fulfil your needs. We understand that choosing the right insurance plan can be overwhelming with our FOUR STEPS approach

We don’t just sell policies; we create financial security strategies tailored to you.

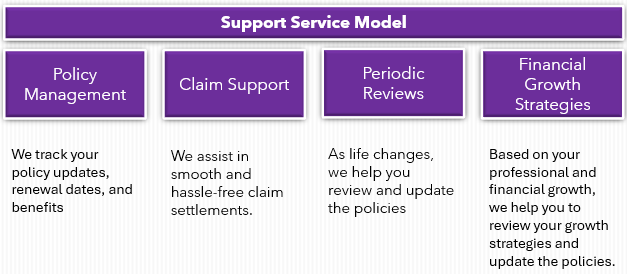

Value Added Services from Mahavir Consultancy

Support to your Ongoing Policies is the major forte of Mahavir Consultancy. Choosing a policy is just the beginning. With Mahavir Consultancy, you get ongoing support to maximize your benefits.

With over 23 years of experience, Mahavir Consultancy is committed to helping individuals and businesses secure their future with the right insurance solutions.

Final Thought:

Health insurance takes care of you today, while life insurance takes care of your loved ones tomorrow. A well-planned insurance portfolio should include both to ensure complete financial well-being.

📢 What’s your take? Do you prioritize health insurance or life insurance? Share your thoughts in the comments! 👇

Get Expert Guidance from Mahavir Consultancy today to secure the right insurance plan for you!

Contact us on 📞 9898004581 / 8735937077

🌐 Website: www.mahavirconsultancy.in

📩 Email: info@mahavirconsultancy.in

📲 Follow us on Social Media:

🔹 Facebook: Mahavir-Consultancy

🔹 LinkedIn: Mahavir-Consultancy

🔹 YouTube: Mahavir-Consultancy

Contact Mahavir Consultancy: info@mahavirconsultancy.in | +91 9898004581